How to perform accounts receivable cut-off procedures with DataSnipper

Learn how to perform procedures to validate the cut-off assertion, for accounts receivable (AR) balances using DataSnipper.

Choose your DataSnipper version:

👉 DataSnipper version 4.1 and later

👉 DataSnipper version 4.0 and earlier

Video tutorial

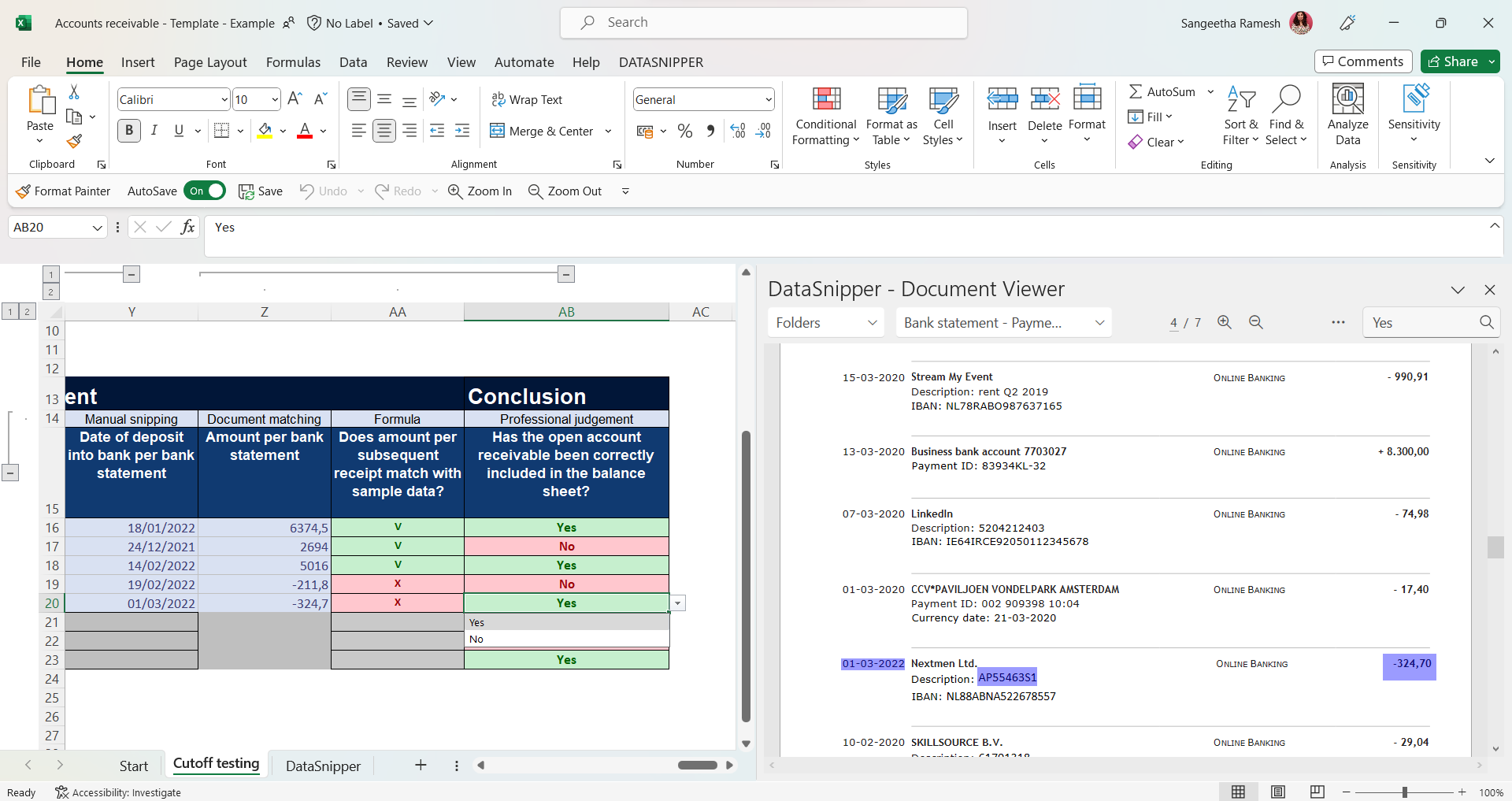

Example

Here you can download the workbook shown in the video including all of the sample data and documents.

ToD AR cut-off procedures - example

Template

Here you can download a blank version of the workbook shown in the video to use or customize for your own procedures.

ToD AR cut-off procedures - template

Prerequisites

- Sample taken from accounts receivable listing in Excel

- Any supporting evidence proving the amount, invoice date, goods/services delivery date, and payment date as well as any other fields required to be reconciled for your procedure.

Start procedure

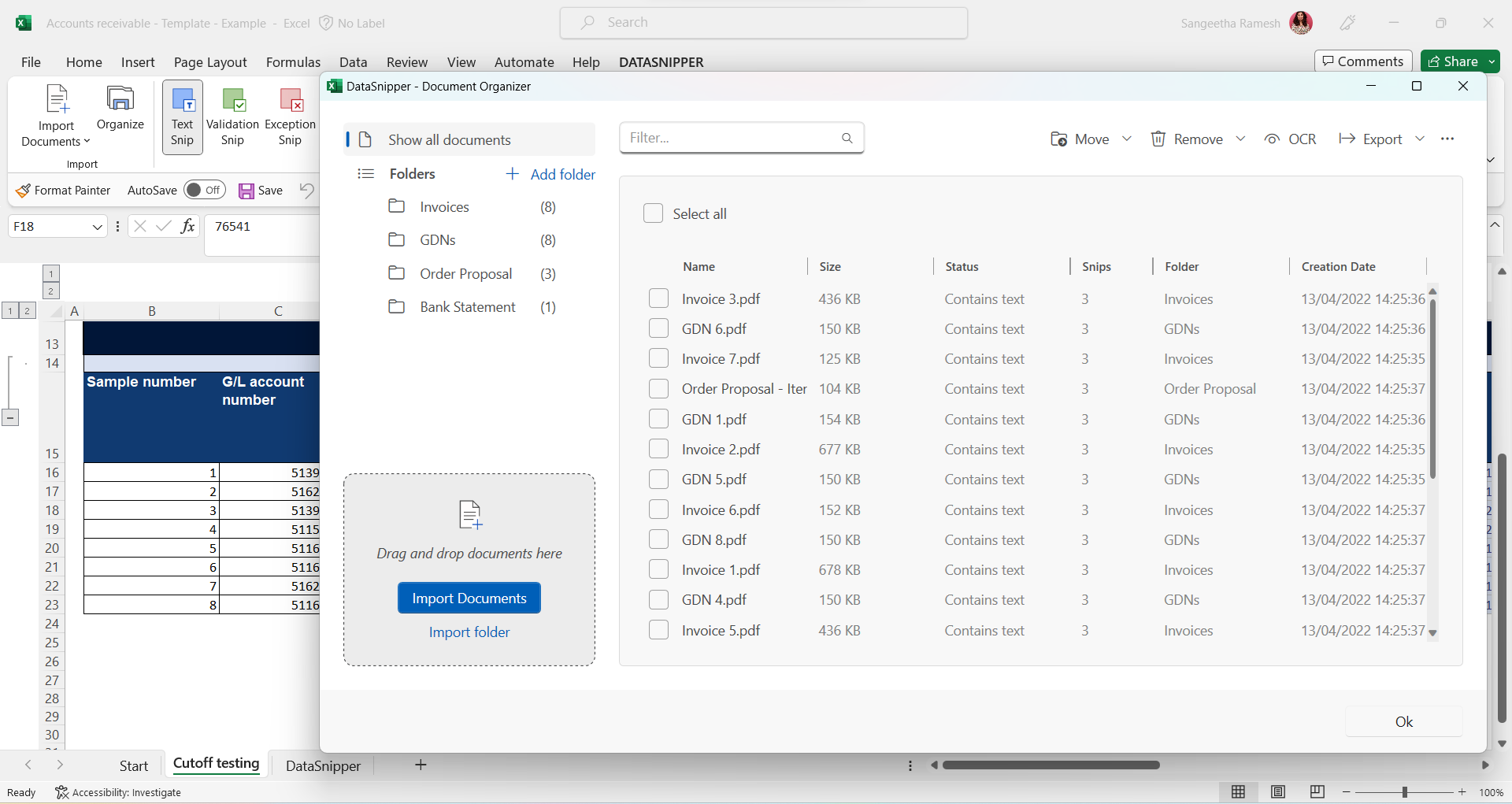

- Start by importing all relevant documents into DataSnipper, i.e., Invoices, Goods Delivery Notes, Order Proposals and Bank Statements.

- Click on Document Organizer and create folders for each type of document you’re reconciling.

- Click on Document Matching and “Start new Document Matching”.

- Select your sample data. If your sample data includes headers, check on the box "First row includes headers" & click Next.

- Select “Use documents folders” & check the boxes of folders you would like to use. Next, check the output columns and adjust them according to your procedure.

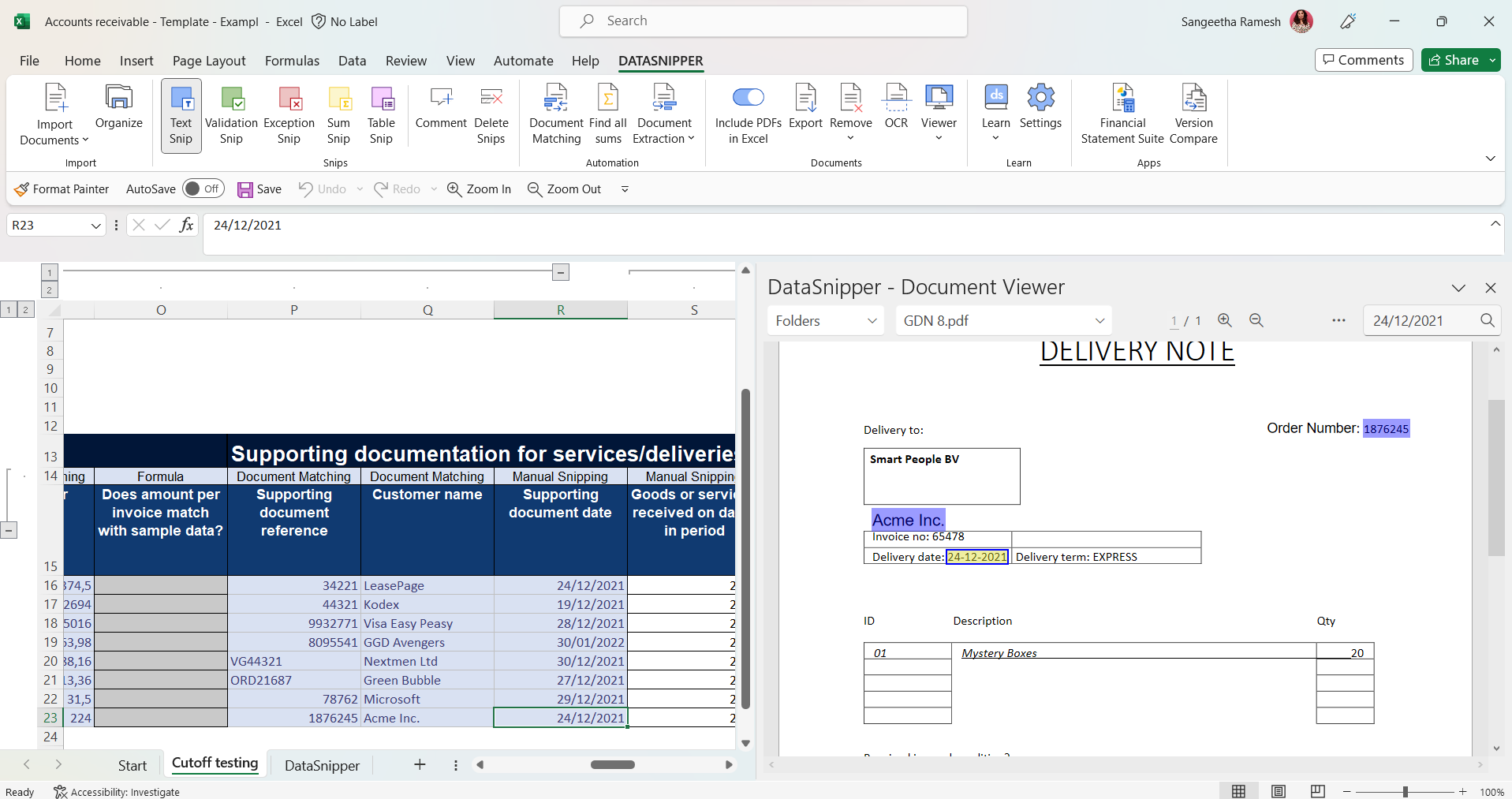

- Click "Match all rows" and DataSnipper will automatically match the input and output columns for you. Once the match is complete, you can review the output by moving through the snipped cells.

- Use Text Snips to extract more information (such as the delivery and payment date).

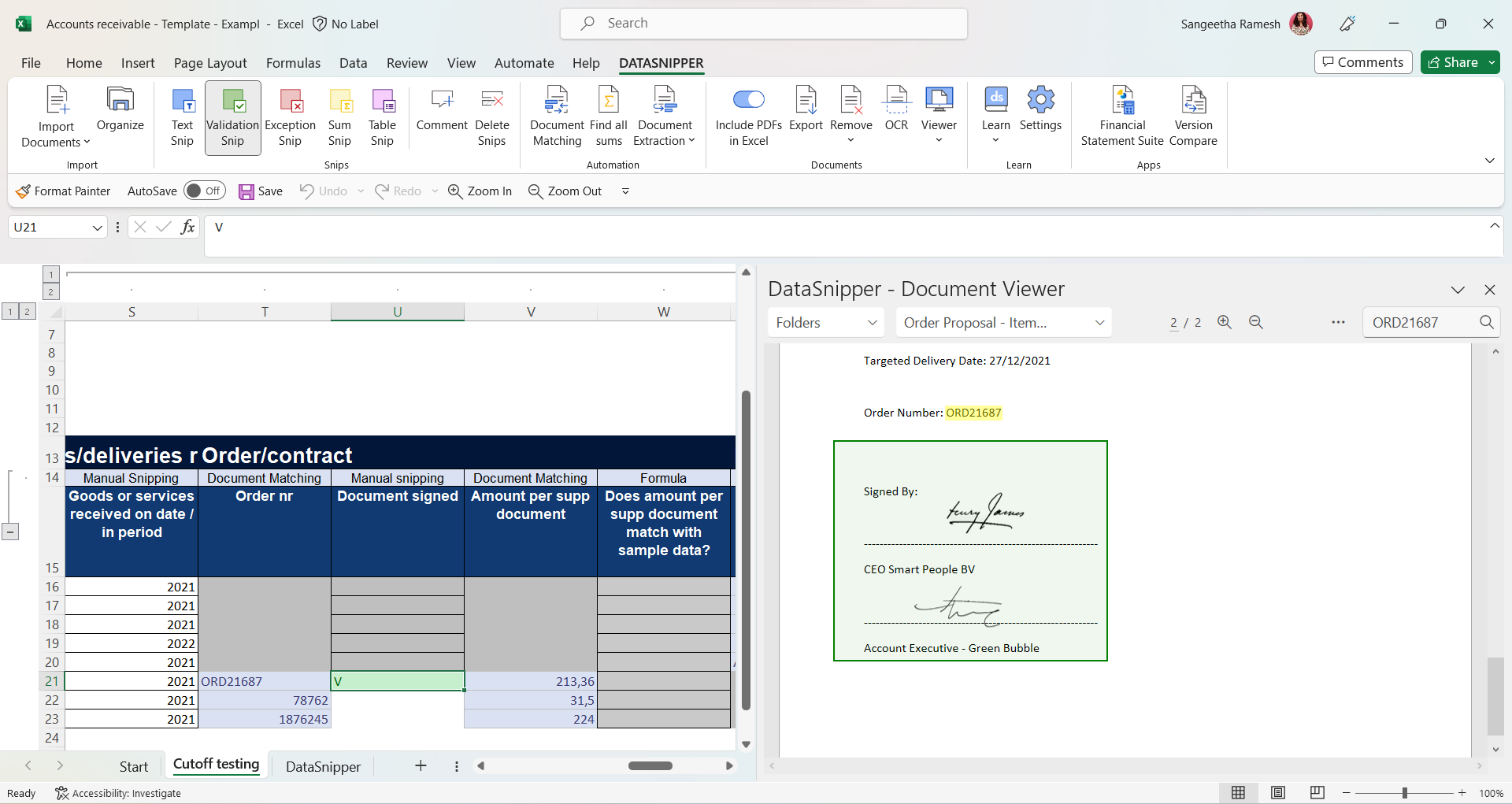

- Confirm that any order proposals used (in case the receivable is not yet paid) were signed and countersigned.

- Review each set of documents and check if it was correctly included or excluded from the AR listing.

You always have the option to set tolerance thresholds in document matching for amounts or dates if you aren't sure that you will be able to make an exact match, please click here to learn more

DataSnipper version 4.0 and earlier

Sharing the file

- You can choose to exclude all documents before saving the workbook in your audit file, by selecting the include/exclude documents toggle.

- You have some options to delete specific documents, please click here to learn more.